Because of fast technology growth, AI is significantly changing personalized finance management. Since financial systems are becoming more complicated, AI’s role in processing many data points, spotting upcoming trends, and providing predictions is improving financial well-being for individuals and companies. Modern techniques and personal financial advisors have replaced the traditional method of recording my expenses. AI now gives budgeting, investing, and credit management tools the ability to provide customization that was out of reach in the past.

AI in finance management mainly improves decision-making by providing top efficiency and accuracy. With these, you can choose methods that fit your routine and anticipate what’s next, modernizing and improving your plan. Artificial intelligence changes the financial world by guiding savings, handling investments, and giving instant advice. The main idea is to ensure money is simple for all, giving them tools to choose better and save for the long term.

Also Read: 8 Powerful AI Techniques to Dominate Search Rankings with High-Quality Content

AI: A New Era for Finance Management and Automated Budgeting

AI adding value to finance management means starting a new period where machines and personal approaches work together to deliver improved financial planning. In the past, handling one’s finances involved a lot of effort, needing constant care over records, spreading the work across many spreadsheets, and talking with advisors regularly. As a result, this method often led to an inability to use opportunities fully. AI has made it possible to upgrade financial management, making it more accessible for many and more accurate for decision-making.

The main point of this revolution is that AI is able to analyze lots of real-time data, spot patterns, predict trends and guide financial choices. Machine learning helps AI systems adjust their predictions about people’s behaviors, aims and financial habits, so they can offer unique financial products. Because of this personalization, users can play a bigger role in managing their money, so they are not just following advice that does not change.

By predicting what the market will do next and suggesting updates to investment strategies, AI improves how efficient financial management is and allows users to decide without too much manual effort. Financial planning reaches new heights with detailed features and becomes more intelligent and user-friendly.

Thanks to AI-powered applications, automated budgeting makes it much easier and smarter for individuals to monitor and improve their finances. Individuals can now track their spending automatically, without spending time adding figures in spreadsheets. Also, Mint and You Need a Budget (YNAB) use machine learning to easily categorize your transactions and give instant spending reports, simplifying the budgeting process.

These artificial intelligence systems analyze your finances, learn habits, point out common costs, and suggest ways to reduce unwanted spending. Since these tools track spending in real time, they automatically change budget recommendations as needed, so users always stay on track. Additionally, AI’s forecasting abilities make it easy to budget for upcoming expenses, meaning you won’t be surprised by forthcoming holidays or life events.

These applications improve accuracy by examining individuals’ budgeting habits and help people easily set, keep an eye on, and achieve their financial goals. Automating day-to-day tasks with AI helps people manage their finances more easily and makes it easier to decide what’s best financially. It creates an adaptable budgeting approach that looks at the future, helping users avoid using only old budgeting tools.

Making Confident Investment Decisions: How to Build Your Wealth

Many consider investing difficult, requiring expertise and hard work to make the right decisions. Yet, with AI, wealth management is being modernized through custom investment methods that change and run automatically. Today, you don’t need to depend on people for advice about the stock market or creating different asset portfolios. Thanks to Wealthfront and Betterment, investing can now be done easily, more quickly, and catered to your needs personally.

Using advanced software, such services create portfolios that match each user’s goals, how much risk they are willing to accept, and what they prefer. AI watches market trends and changes portfolios whenever necessary, so investments match the current situation. With this approach, investors can grow their wealth more simply and don’t have to engage constantly.

It is worth noting that AI is very successful in helping to reduce risk. Studying detailed data and market indicators, these systems anticipate risks, identify the beginning of market shocks, and modify strategies. For those who have invested for years and want their portfolio to change with the market, and newcomers looking for a simple way to build wealth, AI-driven tools are an excellent resource for making a strategy that helps you grow your funds.

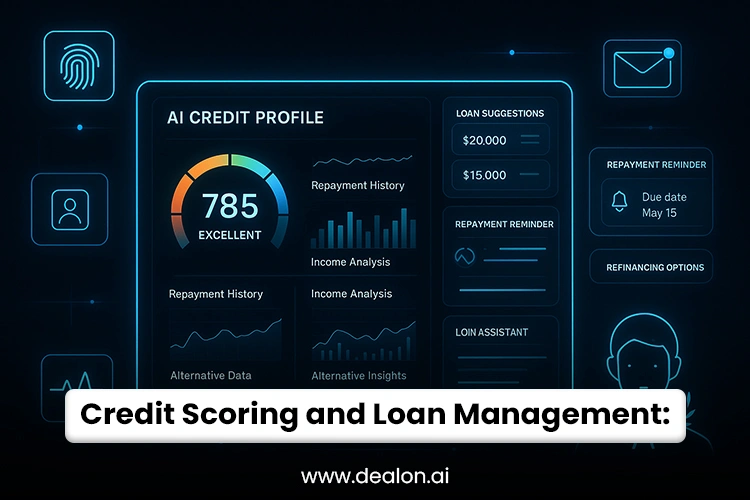

Credit Scoring and Loan Management: Getting It Right

With the help of AI, processing credit and loans is now more accurate, holistic, and customized to each person. Models used by traditional credit reports, such as FICO, depend primarily on limited information, concentrating on credit history, how much debt a person has, and whether payments are always on time. They don’t include the whole picture of financial actions and background that help determine if a loan can be repaid. AI joins here, making credit scoring more effective by checking additional details.

Advanced algorithms in AI-backed credit scoring look at credit information, spending habits, different ways income is earned, and even social habits, giving a more complete view of a person’s finances. AI can examine how often a person misses a payment, how much extra cash they get monthly, and if they stick to a budget well. Hence, measuring credit risk improves, helping make more precise and fair decisions that do not depend on old and fixed ideas.

AI in credit scoring helps decrease favoritism and improve access for many. Some credit risk methods deduct points if your credit history is limited or non-existent, mainly hurting young people, migrants, and individuals trying to recover financially. Considering alternative data, AI allows individuals with unique financial backgrounds to gain credit that they may have been refused.

In addition, AI plays an integral part in the management of loans. Such tools can send tailored messages about making payments, recommend the best ways to manage debts, and inform users about refinance offers that could help them save money or pay off debts sooner. Being able to guide borrowers keeps each client on the right path and helps them choose better ways to manage their finances and increase their overall stability. AI adoption in finance makes credit and loan processes more open, efficient, and accessible to more people.

Online financial help: AI-backed chatbots and advisors.

Because of AI, chatbots and virtual financial advisors are changing how individuals handle their money by providing quick, customized suggestions impossible before. People can use financial services immediately, thanks to virtual assistants like Erica from the Bank of America and Cleo, available anytime. These solutions can deal with many financial questions thanks to AI, from basic fund transfers to complex portfolios. Therefore, they are invaluable for anyone who wishes to manage their money better.

Virtual assistants are always different and unique because they adapt to how a person uses money. As these AI systems are used, they gain experience through patterns in data and eventually get better at personalized recommendations. If a user inquires about budgeting or available investments, the assistant will gradually help the user make sound financial choices. This personal method means financial advice is given when needed and matched to the user’s goals and preferences.

They also help with regular operations such as bill payments, moving money, and making changes to your portfolio. By simplifying these actions, much of the heavy lifting in managing finances is removed so that users can focus on important decisions. They also include advice for saving, investing, and boosting credit scores, which helps people become financially active.

Financial Security: Avoiding Fraud

More and more, AI is central to keeping our finances safe with exceptional defense against digital fraud. Many financial companies are starting to use machine learning to detect and address fraud taking place in their systems. They process constantly arriving data to detect questionable activity that may represent fraud. AI helps detect unusual activity, repeated withdrawals from multiple sources, or account details that look stolen, usually before the user sees them.

AI can spot fraud because it works with a lot of information and is very accurate. Unlike standard security systems, AI keeps learning and changing as transaction behaviors evolve. Because of this, it is tough for criminals to exploit weaknesses in financial systems. With criminals getting better at what they do, AI is also strengthening fraud detection tools, helping prevent threats before they happen.

AI technology does more than detect fraud; it can also help prevent it. AI prevents users from losing money by instantly spotting suspicious activity and blocking it. Some systems also confirm the identity of users with biometrics, so access by someone else is less likely.

The high risk of financial fraud means that AI is important in cybersecurity, helping individuals and groups remain safe in the digital economy. By responding to new difficulties, AI makes the economy more stable and helps users stay safe from cyber threats.

Leveraging Technology to Help Users Make the Best Financial Decisions

AI is improving the way individuals access and interact with financial information. AI is playing an central role in financial education. Usually, only people who could understand complex words, get the needed materials or pay for them could benefit from financial literacy. Because of AI, people from all walks of life can access and understand financial education suitably.

People are learning financial concepts more easily thanks to chatbots, interactive tutorials, and smart simulations powered by AI. The use of these tools allows for lessons tailored to a user’s speed of learning and personal finances. For new users, there are basic budgeting guides, and those interested in stocks will be given information about current trends and risk management practices relevant to them.

AI can learn from a user’s finances and help them by suggesting functional educational materials. Should a user keep overspending, emphasis is automatically placed on helping them learn about budgeting, controlling debt and saving ahead of time. With these tools, users are led gradually to understand essential financial rules before they decide on big matters.

Thanks to AI, users receive constant advice and can refresh their knowledge to create better budgets, invest wisely and control debt. Because AI is sharing useful information, it is helping people grow their financial knowledge and confidence which makes it simpler for them to lead their financial lives. Ultimately, AI offers financial education to everyone and aids in better and wiser money decisions.

Accessible and Inclusive Personalized Finance Management

AI-driven personal finance management is on the verge of making a significant, inclusive change. AI growth will lead to better, easier-to-use, and more tailored financial tools, ensuring everyone can take advantage of their benefits. Because AI can review and study significant data, users will get better financial intelligence, helping them make smart, data-supported decisions. With progress in AI, finances will be easier to handle, making it smoother for users.

Artificial intelligence is helping financially manage, giving people access to resources and advice that were once available mainly to the richest people or financial experts. Customized budget advice, investment options and credit score reviews are available for users who take advantage of personalization. Features once only for the wealthiest clients will soon be open to everyone.

In addition, the prices of these tools will continue to drop as AI keeps advancing. Traditional ways of getting financial advice can be expensive and difficult to get for many people. Even so, AI-backed tools will help to ensure that advanced money management can be reached by anyone. If it’s supporting a customer who has not built up credit or giving guidance on investments to those starting out, banks can help.

In the future, using AI in finance management will make financial information more accessible and support more economic fairness. Making modern, AI-based financial services easy will mean everyone can work towards their financial dreams.

Conclusion

Because of AI, managing personal finances has been revamped, giving individuals robust solutions to manage their finances more effectively. Thanks to AI, budgeting, selecting investments, and receiving financial help in real time are now simpler and safer. With advanced algorithms and ML, AI tools can offer custom suggestions that adapt as every user manages their finances, making looking after finances easier and more effective.

AI is also increasing equity and access in the financial sector for a larger group of people. Because financial tools are available to everyone, people from various backgrounds can use services that were once meant only for those with great wealth. AI ensures that finance management advantages are available to everyone, regardless of what they have in their wallets.

AI will increasingly be involved in finance management, giving us even better insights, greater automation, and more customization in the future. The further development of AI makes it affordable and available to everyone, ensuring that each person can choose their next financial step and feel safe in a digital world. Because of the unmatched abilities of AI, personalized finance management looks good for the future.